In Nigeria and other countries, a vehicle’s number plate number is one of the recognised ways for the government to identify a particular vehicle. However, it is obvious that sometimes several vehicles can have the same model, colour, and characteristics, making it practically hard for people to tell them apart.

As a result of this development, the concept of the vehicle plate number was developed to make it simple for people to identify individual vehicles or automobile in the event of auto theft.

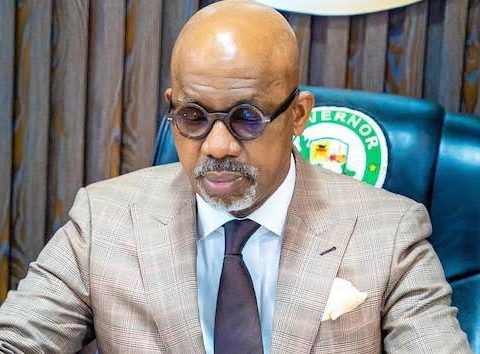

Ogun state, like every other state, has established procedures on how to register your motor plate number at ease and Ogunwatch has provided them in this post.

The table below shows the registration fee for different vehicle plate number in Ogun according to your vehicle type.

Advertisement

| Vehicle Type | Revalidation/ Replacement (₦) | Number Plate (₦) | Registration GMR (₦) | Hand Book (₦) | P.O.C (₦) | Vehicle Licence (₦) | Testing Form (₦) | Hackey Stage Carriage (₦) | Total (₦) |

| VEHICLES 1.4cc | 10,000 | 12,500 | 3,125 | 1,250 | 300 | 1,250 | 1,250 | 1,300 | 19,675 |

| VEHICLES BELOW 1.6CC WITH STD PLATE | 10,000 | 12,500 | 3,125 | 1,250 | 300 | 1,875 | 1,250 | 1,300 | 20,200 |

| VEHICLES BTW 1.6 – 2.0cc WITH STD PLATE | 10,000 | 12,500 | 3,125 | 1,250 | 300 | 2,500 | 1,250 | 1,300 | 20,925 |

| VEHICLES 2.1 – 3.0cc WITH STD PLATE | 10,000 | 12,500 | 3,125 | 1,250 | 300 | 3,125 | 1,250 | 2000 | 21,550 |

| VEHICLES ABOVE 3.0cc | 10,000 | 12,500 | 3,125 | 1,250 | 300 | 3,125 | 1,250 | 2,000 | 21550 |

| MOTOR-CYCLE (PRIVATE) | 2,000 | 2,500 | 1,550 | 625 | 375 | 200 | 5,250 | ||

| MOTOR-CYCLE (COMMERCIAL | 2,000 | 2000 | 1,550 | 625 | 375 | 200 | 5,250 | ||

| TRI-CYCLE | 2,000 | 2,500 | 1,550 | 625 | 1,250 | 1,300 | 7,225 | ||

| BUSES (MINI) | 10,000 | 12,500 | 3,125 | 1,250 | 300 | 3,125 | 1,250 | 2,000 | 23,550 |

| PICK UP VAN | 10,000 | 12,500 | 3,125 | 1,250 | 300 | 3,125 | 1,250 | 2,000 | 23,550 |

| BUSES (BIG) E.G COASTAL, (LUXURIOUS) | 10,000 | 12,500 | 6,250 | 1,250 | 300 | 6,250 | 3,750 | 3,200 | 33,500 |

| TIPPERS AND LORRIES | 10,000 | 12,500 | 6,250 | 1,250 | 300 | 6,250 | 3,750 | 3,200 | 33,500 |

| TRUCKS | 10,000 | 12,500 | 6,250 | 1,250 | 300 | 6,250 | 3,750 | 3,200 | 33,500 |

| TYRES TRAILER (ARTICULATED N/PLATE) | 7,500 | 20,000 | 6,250 | 1,250 | 300 | 8,750 | 3,750 | 3,800 | 44,100 |

| TRACTORS AND BULLDOZER | 17,500 | 20,000 | 6,250 | 1,250 | 300 | 8,750 | 3,750 | 3,800 | 44,100 |

How to apply for vehicle plate number in Ogun

Applicants desiring to obtain a registered vehicle plate number in Ogun state should go to the OGIRS PORTAL https://portal.ogetax.ogunstate.gov.ng/vehicle to create an account and fill a form for registration.

After registration, print the completed form, attach other relevant documents and submit to the office of the Ogun State Internal Revenue Service at Parastatal building, Oke Mosan, Abeokuta.

How to pay for vehicle plate number in Ogun

Pay the needed sum for plate number’s registration in the selected bank before submitting the documentation. Then include a photocopy of the payment teller with the document you plan to submit.

If requested, provide the original teller but keep a photocopy or acknowledgment receipt as proof of payment in case of an emergency.

VIO Examination

Vehicle inspection officers are the organ in responsibility for confirming a vehicle’s roadworthiness. At this point, the applicant takes the car to the car Inspection (VIO) Office for physical confirmation.

If the vehicle is confirmed, a certificate of roadworthiness will be given and attached to the vehicle licence.

Confirmation from Road Safety

The Road safety officers there will verify any issued documents, including driver’s licences, insurance policy numbers, forms of identity, and proofs of address.

In order to expedite processing and registration of the plate number, the official in charge will then issue an approval notification to the Board of Internal Revenue.

Then to finally obtain the vehicle plate number in Ogun, return to the Ogun State Internal Revenue Service where you first sent in your application and supporting documentation.

Here are help contact points: email address: info@ogunstaterevenue.com and phone number: 08060240778 & 0807058065.