Education is the key to unlocking opportunities and fostering economic growth. However, the high cost of higher education has been a significant barrier for many Nigerian students, particularly due to the prevailing unemployment rates. To address this issue, the Nigerian government has recently enacted the Students Loan Act, which aims to provide easy access to higher education through interest-free loans from the Nigerian Education Bank.

In this post, we will discuss the key provisions of the act and its potential impact on Nigerian students, taking into consideration the challenges posed by high unemployment rates.

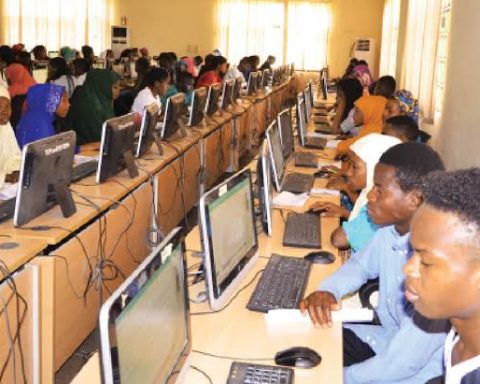

The Students Loan Act ensures that all students seeking higher education in public institutions of higher learning in Nigeria have equal rights to access the loan.

This Acts prohibits any form of discrimination based on gender, religion, tribe, position, or disability. It aims to create a level playing field for students from diverse backgrounds, allowing them to pursue their educational aspirations without financial constraints.

Advertisement

How to apply for Student Loan?

To apply for a loan under this Act, students must meet certain conditions. These conditions include securing admission into a Nigerian university, polytechnic, college of education, or vocational school recognized by the federal or state government. Additionally, the student’s income or family income must be less than N500,000 per annum. The application must be accompanied by at least two guarantors, who should meet specific criteria such as being civil servants of a certain level or legal professionals with substantial experience.

Establishment of the Nigerian Education Bank:

The Act establishes the Nigerian Education Bank as a body corporate responsible for the implementation, administration, and monitoring of the students’ loan program. The bank will have the authority to receive loan applications, screen applicants, approve and disburse loans, and ensure compliance with loan repayment obligations.

Loan Disbursement and Repayment (Students Loan Act):

The loan disbursement process will be initiated within 30 days of the application reaching the Nigerian Education Bank. Beneficiaries of the loan will commence repayment two years after completing the National Youth Service Corps program. Repayment will be facilitated through direct deductions of 10% of the beneficiary’s salary at source by the employer. Self-employed individuals will be required to remit 10% of their total profit monthly to the designated Students Loan Account.

Role of the Nigerian Education Bank:

The Nigerian Education Bank will have various responsibilities, including supervising, coordinating, and administering the management of the students’ loan program. It will also monitor academic records of loan beneficiaries to ensure timely repayment, liaise with employers for salary deductions, and provide financial advice on educational matters. The bank will engage in other banking activities and enforce the provisions of the Act to recover loans when necessary.

The Act establishes a Governing Board for the Nigerian Education Bank, responsible for overseeing its functions. The Board comprises individuals from various sectors, including education, finance, labor, and legal professions. Board members will be appointed by the President, subject to confirmation by the National Assembly.

The Students Loan Act represents a significant step towards providing easier access to higher education for Nigerian students. By establishing the Nigerian Education Bank and implementing interest-free loans, the Act aims to alleviate the financial burden faced by students and increase educational opportunities. However, considering the prevalent issue of high unemployment rates, analysts have raised concerns regarding the capacity of indebted students to repay such loans.

After reading this summary, intending applicants and guardians are advised to carefully read the full document of the Act in order to have a concrete grasp of the programme and it’s implication. To download the full document of the Students Loan Act, you can click here.