The Central Bank of Nigeria (CBN) recently highlighted the significant impact of declining crude oil output on the country’s economy.

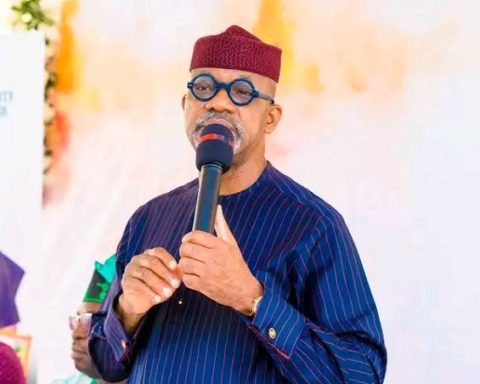

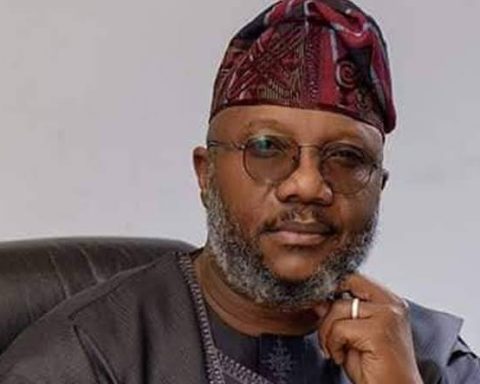

Speaking at the Annual Bankers’ Dinner of the Chartered Institute of Bankers of Nigeria, CBN Governor Olayemi Cardoso outlined the repercussions across various sectors, emphasizing the strain on public finance.

Cardoso explained that the continuous decline in crude oil production has further weakened Nigeria’s economic diversification, resulting in adverse indicators and limiting policy options.

This situation has contributed to increased fiscal deficit, public debt, and exchange rate instability, putting additional pressure on external reserves.

Advertisement

To address these challenges, the CBN has implemented various policy measures, including the removal of the petrol subsidy and the adoption of a floating exchange rate.

These steps aim to enhance investor confidence, attract capital inflows, stimulate domestic investment, and ultimately improve external reserves and stabilize the domestic currency.

Cardoso also discussed the broader economic challenges facing Nigeria, such as high and rising inflation, inadequate foreign exchange supply, depreciation of the exchange rate, limited external reserves, weakened output, and high unemployment. He emphasized the importance of stable prices for businesses and ordinary citizens.

To mitigate these challenges, the CBN has undertaken measures such as regular Open Market Operations (OMO) to manage excess liquidity, offering Treasury Bills to the public, removing the cap on the remunerable Standing Deposit Facility (SDF), sustaining Cash Reserve Requirement (CRR) debits, and inaugurating a new liquidity management committee.

Cardoso reported initial success in these efforts, with a significant reduction in excess liquidity, increased OBB rate, and a decline in month-on-month inflation.

The CBN remains confident that continued tightening measures over the next two quarters will effectively manage inflation and work towards achieving price stability, fostering sustainable economic growth, stabilizing the exchange rate, and reducing interest rates to encourage borrowing and investments in the real sector.